London-based group plans to reopen Bayou Steel: Liberty Steel Group makes $28 million bid, plans 2021 reopening

Published 12:05 am Saturday, December 28, 2019

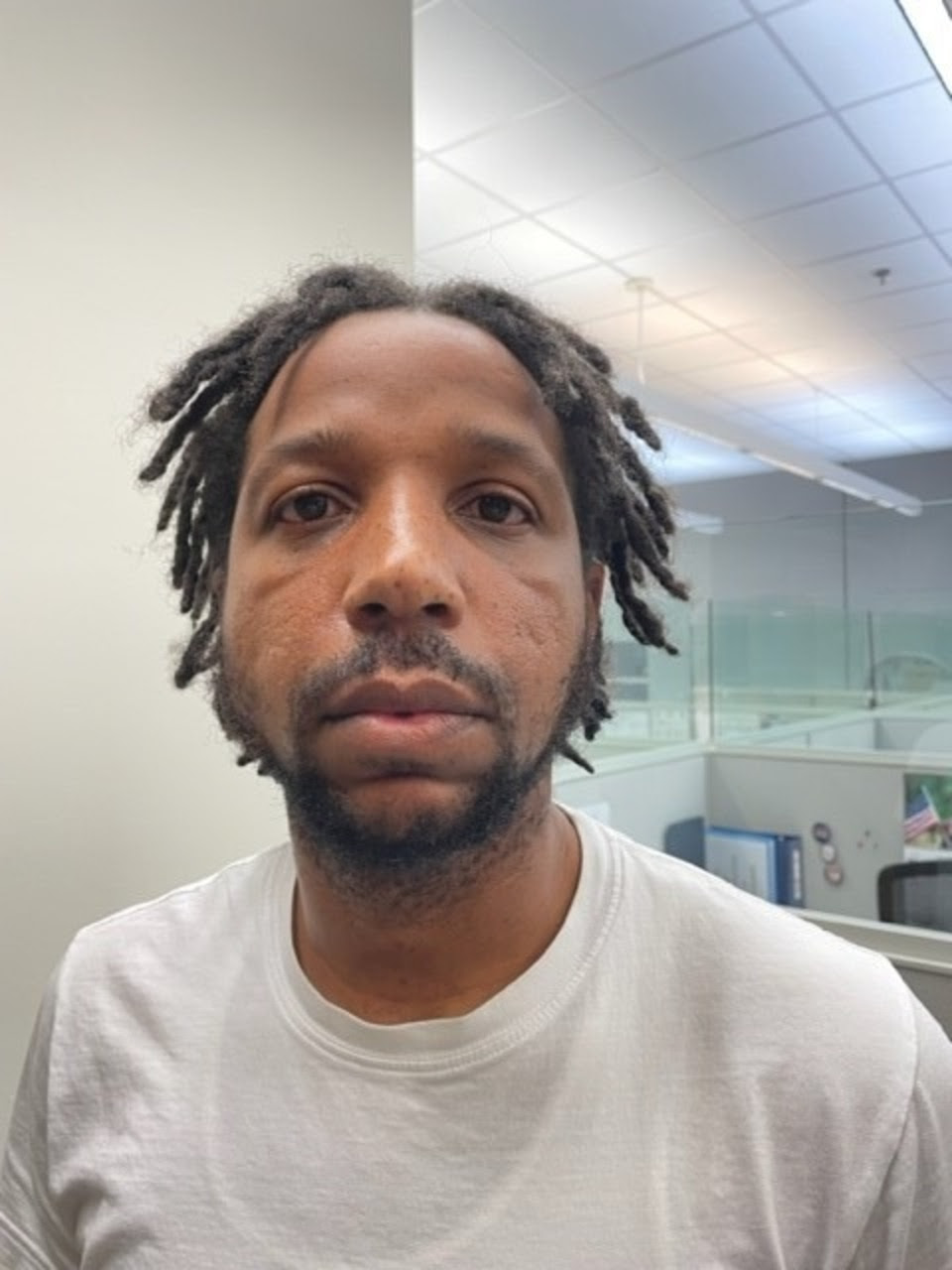

- Bayou Steel’s LaPlace location, pictured above, shut down in September, leaving all 376 employees out of work. Liberty Steel of London is now one step closer in its bid to purchase Bayou Steel and restart operations.

LAPLACE — Liberty Steel Group was confirmed as the preferred buyer of Bayou Steel’s idled facility in LaPlace this week during a U.S. Bankruptcy Court hearing in Wilmington, Delaware.

The transaction is expected to close on Jan. 31, 2020. Liberty intends to modernize the steel mill, restart recycling operations in the latter half of 2020 and resume steel-making operations by 2021, according to a company press release.

Liberty Steel Group, based in London, submitted a bid of $28 million in cash for the acquisition.

Bayou Steel abruptly ceased operations at 138 Highway 3217 in LaPlace the end of September with the immediate layoff of 376 employees. Many of the employees said the layoff came without warning and had devastating impacts on their families.

On Oct. 1, the company filed for a Chapter 11 bankruptcy protection. Bayou Steel Group owed more than $20 million to dozens of creditors, according to court documents available at kccllc.net.

Bayou Steel was the No. 4 employer of St. John the Baptist Parish residents in 2018 and a major contributor to the tax roll, with 400 employees accounting for two percent of the local working population. The company’s roots in LaPlace trace back to 1979. The first mill was commissioned several years later, and recycling operations began in 1995.

The acquisition of Bayou Steel would add to Liberty Steel Group’s existing operations in Illinois, Ohio, New Mexico and South Carolina.

According to a Liberty press release, the acquisition is in line with Liberty’s GREENSTEEL Vision with a goal to achieve carbon neutral steel production by 2030.

The GREENSTEEL Vision focuses primarily on renewable sources of energy and recycled materials.

Liberty Steel Group is part of the GFG Alliance, a global group headquartered in London. The alliance is made up of energy, mining, metal and engineering companies.

Sanjeev Gupta, executive chairman of CFG Alliance, said he looks forward to welcoming Bayou Steel into the GFG Alliance family.

“While the plant requires upgrades to be restarted competitively, we see good potential for the business,” Gupta said. “Bayou [Steel] benefits from reliable access to supplies of recycled steel, competitive power prices and its own deep-water port.”

Grant Quasha, GFG Alliance’s Chief Investment Officer for North America, said, “We put together a compelling bid to save the business, and we see an excellent fit in terms of our group values, our existing operations in the USA and the wider ambitions of the Liberty Steel Group globally.”

Quasha said the immediate focus would be on restoring the steel recycling supply chain and operations and the facility.

“Once fully upgraded and operational, the business will bring our total production capacity in the U.S. to 3 million tons per annum, moving us closer to our target of an aggregate 5 million tons of steel production in the U.S.,” he added.

With assets around the globe, Liberty Steel has capabilities that range from liquid steel production to high value precision-engineered products.

In 2018, Liberty Steel purchased a vacant wire rod mill in South Carolina. In 2019, it acquired a separate wire rod and bar steelmaker in Illinois.